Using Your FSA and HSA Funds | CMI Health Blog

How to Use Your FSA/HSA Funds

Are you unsure of what to do with your FSA or HSA funds at the end of the year? FSA (Flexible Savings Account) and HSA (Health Savings Account) funds are fantastic ways to save money on healthcare, but sometimes these benefits can be confusing. With the end of the year quickly approaching, we wanted to share some information about how to best use your FSA/HSA Funds and the benefits they include. Both accounts can be used to pay for different healthcare expenses, totally tax-free. They cover things like prescriptions, over-the-counter (OTC) medical products, and even health insurance deductibles.

An FSA is an employer-based savings account you put money into that you can use for out-of-pocket medical related expenses. Employers can contribute to your FSA, but they aren’t legally required to do so. An HSA is a personal savings account used only for medical expenses. To be eligible, you must be enrolled in a high-deductible health plan (HDHP). You typically do have to be on a health insurance plan to be eligible for both accounts, but sometimes a limited purpose FSA can be acquired without health insurance. View this chart to learn more about the differences between the two savings accounts.

HSA funds are typically less strict than FSA funds, as they do roll over into the next year and can be moved with you between jobs. FSA funds do not usually roll over into the next year. This “use it or lose it” policy is important to take note of, especially if you have a fair amount of unused funds in that account. Depending on your employer, you may be able to roll over a percentage of your FSA Funds into the next year. But be careful as that percentage can be as small as 50%, meaning you’ll lose half of the funds in your FSA. These unused funds will most likely go back to your employer.

HSA funds do have more flexibility and portability than FSA funds, but they aren’t for everyone. With the high-deductible insurance requirement, some who suffer from chronic conditions that require regular treatment won’t find the same financial benefits as others with HSA funds. Having an FSA fund can be more ideal for some as there aren’t as many eligibility requirements and account holders get access to the entire annual amount on the very first day of the plan year. These funds can also be borrowed in advance, as you will end up paying for your elected annual amount throughout the year.

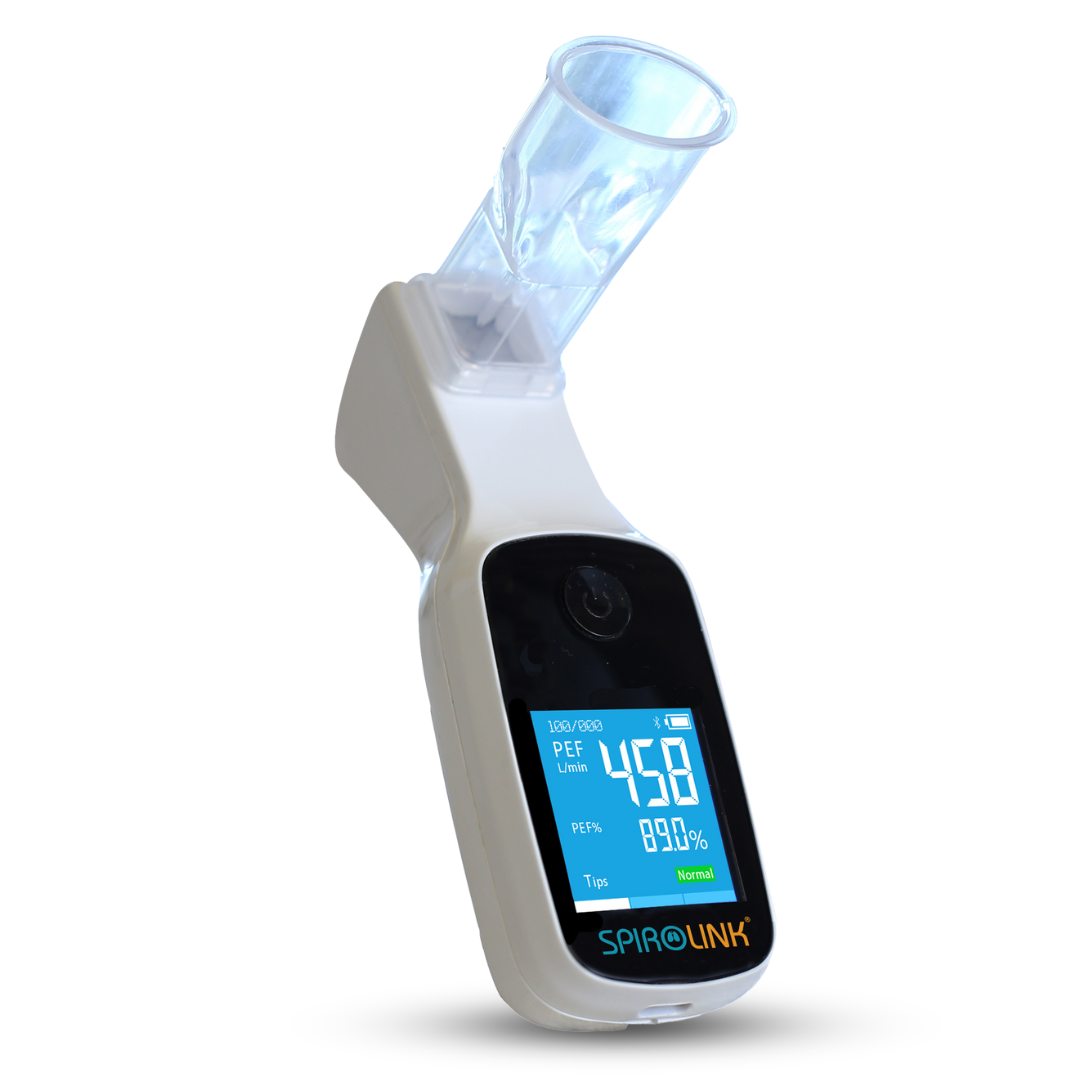

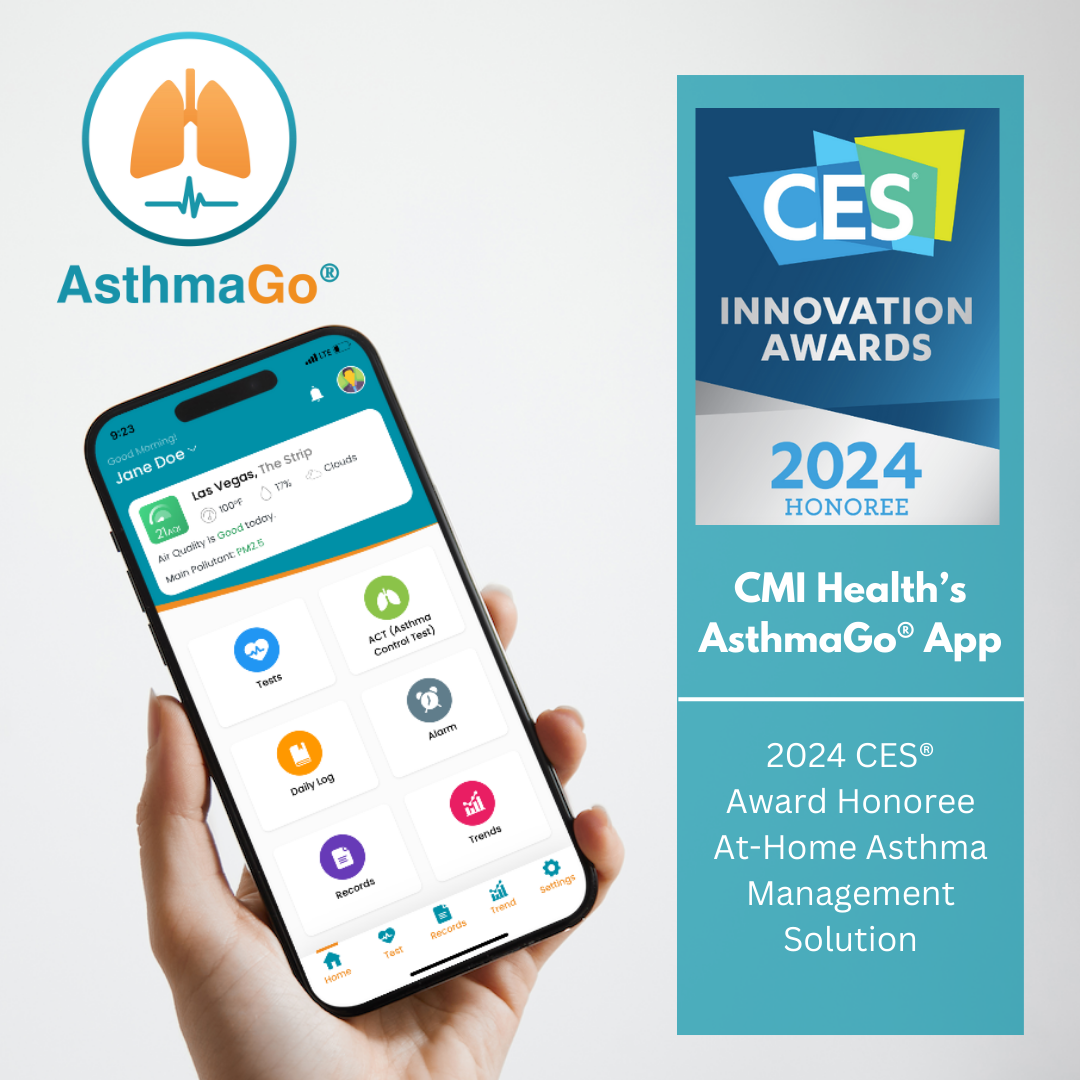

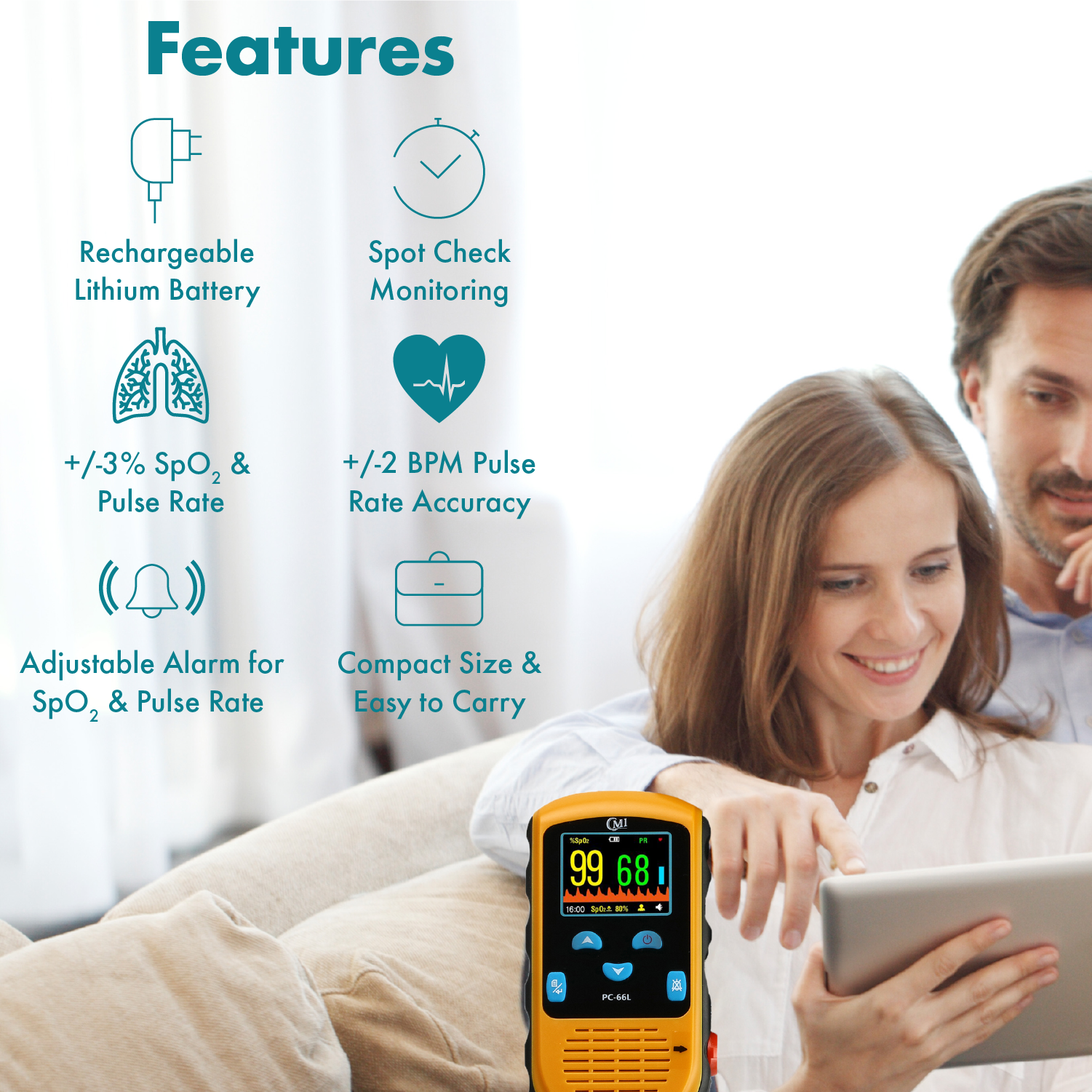

Context matters with these accounts, as they can help cover larger costs such as dental and vision expenses or less expensive OTC products and devices. What you decide to spend these funds on and how much you contribute to them entirely depends on your personal health and your needs. If you’re interested in using these funds to purchase any of our medical devices, we have an exciting announcement for you. Our bi-annual sale will last for the whole month of December – the discounts this year are a steal, and we are so thrilled to give our customers these exclusive offers!

At CMI Health, our mission is to bring our customers accessible, professional-grade healthcare devices to use right in the comfort of their own homes. Follow CMI Health to stay up to date with the latest industry news and medical device information to take the guesswork out of purchasing important healthcare devices.

Still have questions? Feel free to contact us at info@cmihealth.com or call us at 888-985-1125 (ext. 1).

Leave a comment